Bullion Bars Free Play

- Free Gold Bullion

- Bullion Bars Free Play

- Bullion Bars Free Player

- Free Silver Bullion

- Platinum Bullion Bar

Silver Bullion Bars

Free Gold Bullion

Investing in silver is gaining popularity, and buying silver coins is not the only option for those looking to make an investment in silver. Silver bars are a smart way to invest in silver, for both the experienced investor who wants large quantities, as well as for the first-time investor. The multiple sizing options and low premiums make silver bars a smart way to invest in silver.

A Short History of Silver Bars

Silver bars are typically 99.9 percent pure silver that has been melted down and minted into bar form in myriad sizes. Silver bullion investors are always purchasing and selling these bars, making them one of the most popular ways to invest in physical silver.

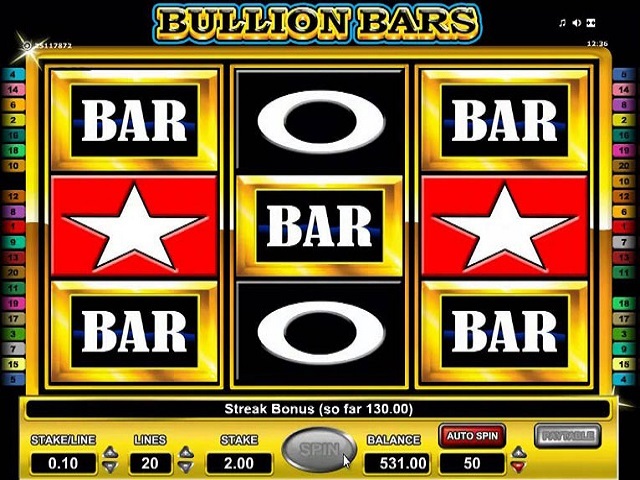

Silver bullion bars have a lower premium than coins in most cases, because it is cheaper to create silver bars than it is to mint coins. The larger the size of the silver bar, the lower the cost of production per ounce, since so many ounces are accounted for in a single bar. So, the larger the silver bar, the lower the premium paid per ounce. Bullion Bars Online Slot. A game with a simple gameplay, but loads of opportunities to win amazing payouts, this 3-reel, 20-payline slot from Novomatic is sure to catch your fancy. You won’t see the usual Wilds and bonus games in this slot, but it does boast a few unique features that make it. These Silver bars range in size from 1 oz to 100 oz and are.999 fine. PAMP Suisse Silver: PAMP Suisse Silver bars are die-struck bars that feature the attractive “Fortuna” portrait common among the company's bullion products. PAMP Suisse Silver Fortuna Bars are guaranteed to be.999 fine. When a bar symbol appears either side of the Bullion Streak icon, you know you’re in for a big win. They’re effectively free spins and the streak name could not be more appropriate thanks to the fact that the reels will keep on spinning until you fail to land a winning combination. 100-ounce silver bars – are usually chosen by experienced silver investors because when looking to buy them in the market, you will realize a lower premium over spot compared to 1 oz and 10 oz weight bars. 1000-ounce silver bars - have the lowest silver price over spot.

Silver has been a monetary commodity for thousands of years, though the exact starting time period is still in debate among historians. Throughout history, it has been mined, bartered, and traded as currency. In the 20th century, silver stopped being used in legal tender. But silver’s value as a precious metal means its production as bullion continued, with people buying coins and bars for the value of silver itself rather than as currency.

Why Silver Bullion Investors Prefer Silver Bars

Some people who invest in silver feel that silver bullion bars are a better investment than silver coins, because they cost less to purchase, and they are easy to store given their uniformity. If an investor wants physical wealth, silver bars are a good way to store a large amount in a relatively small space. Investors prefer the security of physically owning assets, because they’re far safer from inflation and market crashes than paper investments are.

Investors in silver also like to collect silver bars, since different mints have different logos, and because certain editions of bars have stopped being produced, making them more valuable than just the current cost of silver.

Sizes and Mints

Silver bars come in probably the widest variety of sizes ranging from 1 gram to 1,000 ounces. With all of these options available, ten ounce bars and kilo bars are popular among investors, though you can also purchase smaller increments like 5 ounces and 1 ounce. One-thousand ounce bars exist, as well, though they’re generally too large for individuals.

Both private mints and government mints make silver bars. Some private mints known for their quality are the Sunshine Mint and SilverTowne. Mints such as the US Mint, the Royal Canadian Mint, and the British Royal Mint sell silver bullion, but only certain government mints (like the Royal Canadian Mint) sell silver bullion in the form of bars.

Pricing, Quality, and Purchasing

Silver bullion bars have a lower premium than coins in most cases, because it is cheaper to create silver bars than it is to mint coins. The larger the size of the silver bar, the lower the cost of production per ounce, since so many ounces are accounted for in a single bar. So, the larger the silver bar, the lower the premium paid per ounce.

First-time investors should be aware that sterling silver is not the purest form of silver. Almost 8 percent of sterling silver is actually copper. Silver bullion purity is denoted as .999 or .9999, meaning 99.9 percent or 99.99 percent pure. Generally, each mint is going to have its own design stamped on the bars. Along with that, the size and the purity will be stamped on the bars, as well.

Bullion Bars Free Play

When buying bars second-hand, be aware of the condition. Scratches or dents make the bar harder to resell, but that doesn’t mean all second-hand bars are in bad condition. However, second-hand bars will run much cheaper because they lack the extra costs associated with newly minted bars.

Where to Get Silver Bars

Silver bars are available from online retailers, such as ourselves, directly from private mints, physical silver and gold shops, auction sites like eBay, and in some countries directly from banks. Bars produced by certain mints are more readily available than others. Silver.com can help an investor find the correct size and mint, as well as offer introductions to previously unconsidered options. Some sizes are far more common than others, making them more readily available to purchase. Ten and 100-ounce sizes are much more common than 25 and 50.

Bullion Bars Free Player

Free Silver Bullion

Investing in Silver Bars from Silver.com

Platinum Bullion Bar

If silver bars seem like the ideal way for you to expand your precious metals holdings, then Silver.com is happy to help. Our customer service team can answer any questions you might have on the phone at 888-989-7223, online through our live chat, and via our email address. If you have questions about payment methods, we invite you to first view our Payment Methods FAQ, and then reach out to our customer service team for any necessary clarification.